Tax help

As a student at Coast Mountain College, you must provide your SIN number in order to ensure accurate reporting to the CRA. If you have not done so already, please update your SIN information at the front desk of your primary Campus. |

T2202: Education Credit tax forms

What is a T2202 Form?

T2202 (Tuition and Enrolment Certificate) has replaced Forms T2202A for 2019 and subsequent years. It is an official statement for income tax purposes. It is issued to all students who paid income tax return. The form shows the amount of the tuition that can be deducted for income tax purposes as well as the number of months eligible for the education deduction. T2202's are available by the last day of February for the tuition and eligible fees paid in the preceding calendar year.

Tax receipts are issued for the calendar year for the dollar value of tuition for the courses taken between January and December of that year. For instance, if you made a tuition payment in December 2015 for a course that starts in January 2016, this payment amount would be included in the 2016 T2202 form.

For more information, visit the Canada Revenue Agency website.

How do I get my T2202 Certificate?

Your T2202 Tuition and the Enrolment Certificate that you require for your Revenue Canada tax return must be accessed via myCMTN. They will not be sent to you in the mail.

- Sign in to myCMTN Self Service.

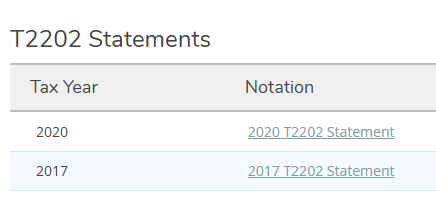

- Navigate to:

- Click on listed statement for the correct Tax Year. It will open as a PDF that you can download or print.

Important!

- No T2202 certificate is produced if total eligible fees are less than $100 for the tax year.

- No T2202 certificate is produced for unpaid tuition or fees.

- T2202’s are not available for developmental programs.

Need help?

Please begin with a review of the Accessing myCMTN page.

If you have done so and still require assistance, please contact the Office of the Registrar.

| Office of the Registrar | ||

|---|---|---|

| info@coastmountaincollege.ca | ||

| Toll-free | 1.877.277.2288 | |

Phone | 250.635.6511 | |

Fax | 250.638.5476 | |

| Support | Sarah Grielens | Ext. 5282 |